NY Real Property Transfer Tax Return - Yonkers 2018-2025 free printable template

Show details

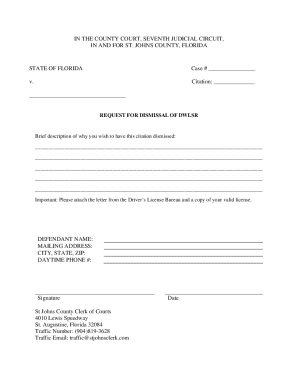

10701 LOCATION OF PROPERTY TRANSFERRED City Tax Map MAKE CERTIFIED CHECK PAYABLE TO CITY HALL TAX OFFICE ROOM 108 Wiring information Sterling National Bank Getty Square Office 61 South Broadway Yonkers NY 10701 ACCOUNT NAME City of Yonkers Transfer Tax ABA 021909300 ACCOUNT 0324910701 Email paperwork To Transfertax YonkersNY. CITY OF YONKERS REAL PROPERTY TRANSFER TAX RETURN FINANCE DEPARTMENT PURSUANT TO CHAPTER 15 TAXES ARTICLE V GENERAL ORDINANCE 8-1973 AS AMENDED BY G.O. 4-1984 G*O....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign yonkers transfer tax form

Edit your yonkers property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your yonkers transfer tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 021909300 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit real transfer return form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application tax form

How to fill out NY Real Property Transfer Tax Return

01

Obtain the NY Real Property Transfer Tax Return form from the New York State Department of Taxation and Finance website.

02

Fill in the property information including the address, block, and lot numbers.

03

Provide the names and addresses of the grantor (seller) and grantee (buyer).

04

Indicate the date of the transaction and the sales price of the property.

05

Calculate the transfer tax based on the sales price using the current tax rates.

06

Complete any additional sections relevant to the transaction, such as exemptions or special cases.

07

Sign and date the form to certify the accuracy of the information provided.

08

Submit the completed form to the appropriate county clerk's office or accompanying agency, and pay any required taxes.

Who needs NY Real Property Transfer Tax Return?

01

Anyone who is transferring or selling real property in New York State.

02

Real estate buyers and sellers who need to report the transaction and pay transfer taxes.

03

Real estate professionals involved in the transaction may also need the form for compliance.

Fill

property tax records

: Try Risk Free

People Also Ask about yonkers transfer

What is the property tax rate in Westchester County NY?

Westchester County collects, on average, 1.62% of a property's assessed fair market value as property tax. Westchester County has one of the highest median property taxes in the United States, and is ranked 1st of the 3143 counties in order of median property taxes.

What towns have the highest taxes in Westchester County?

Croton Has the Highest Taxes in Westchester County.

What is the lowest property tax rate in Westchester County?

The city with the lowest all-in property tax rate was Rye, in Westchester County, at $19.20 per $1,000.

What is the property tax rate in Yonkers?

Average Property Tax Rate in Yonkers LocationMedian Home Value, $Average Property Tax Rate, %Yonkers$392,3002.06%United States$204,9001.16%1 more row

Is Yonkers tax higher than NYC tax?

Yonkers, New York Local Income Tax Yonkers has local income tax for residents, so residents of Yonkers pay only the New York income tax and Federal income tax on most forms of income. The Yonkers income tax imposed on nonresidents is 0.50%, 0.50% higher than the city income tax paid by residents.

Does Yonkers pay NYC tax?

As a resident, you pay state tax (and city tax if a New York City or Yonkers resident) on all your income no matter where it is earned. As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is yonkers property tax?

The property tax rate in Yonkers, New York varies depending on the specific location and property type. As of the 2020-2021 fiscal year, the general property tax rate in Yonkers is approximately $35.68 per $1,000 of assessed property value. However, it's important to note that this rate can change annually, and there may be additional taxes or assessments specific to certain properties or districts within Yonkers. It is recommended to contact the Yonkers City Assessor's office or visit their official website for the most up-to-date and accurate information.

Who is required to file yonkers property tax?

Individuals who own property in Yonkers, New York are required to file Yonkers property tax.

How to fill out yonkers property tax?

To fill out the Yonkers property tax form, you will need to follow these steps:

1. Obtain the property tax form: You can usually find the Yonkers property tax form on the official website of the Yonkers Tax Department or request it directly from the department.

2. Gather the necessary information: Collect all the required information for the form, which typically includes your property's address, ownership details, assessed value, and any exemptions or credits you may qualify for.

3. Complete the property details: Fill in your property's address, folio or account number, and any other relevant details as indicated on the form.

4. Provide ownership information: Enter your name as the property owner and include your contact information such as phone number, email address, and mailing address.

5. Determine the assessed value: Find the assessed value of your property, typically listed on your property assessment notice or on the tax bill. Enter this value in the appropriate section of the form.

6. Apply for exemptions or credits (if applicable): If you qualify for any property tax exemptions or credits, such as the Basic STAR exemption or Enhanced STAR exemption for senior citizens, make sure to indicate them on the form. Provide the necessary supporting documentation as required.

7. Calculate the property tax owed: Based on the assessed value and any exemptions or credits applied, calculate the amount of property tax you owe. This calculation is usually outlined on the form.

8. Sign and date the form: Once you have provided all the required information and calculated the tax owed, sign and date the form to confirm its accuracy.

9. Submit the form: Submit the completed form to the Yonkers Tax Department by mail or online, following the instructions provided on the form or the department's website.

Remember to review the form and verify that all information is accurate before submitting it. If you have any questions or need assistance, contact the Yonkers Tax Department for guidance.

What is the purpose of yonkers property tax?

The purpose of Yonkers property tax, like property taxes in general, is to generate revenue for the local government to fund various public services and infrastructure within the city of Yonkers, New York. The taxes collected from property owners contribute to funding schools, police and fire departments, parks and recreation, road maintenance, public transportation, and other essential services that benefit the community as a whole. Property taxes are typically based on the assessed value of the property and are an important source of revenue for local governments to ensure the proper functioning and development of the city.

Can I create an electronic signature for signing my property liens in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your commissioner tax directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit state entity business straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing property legal.

How do I fill out how to yonkers property tax on an Android device?

Complete yonkers transfer form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is NY Real Property Transfer Tax Return?

The NY Real Property Transfer Tax Return is a form that must be filed in New York State when real property is transferred. It is used to report the details of the transfer and calculate the transfer tax owed on the transaction.

Who is required to file NY Real Property Transfer Tax Return?

The seller of the property or the representative of the seller is required to file the NY Real Property Transfer Tax Return when real property is conveyed in New York State.

How to fill out NY Real Property Transfer Tax Return?

To fill out the NY Real Property Transfer Tax Return, you need to provide information such as the names and addresses of the parties involved, the description of the property, the sale price, and any exemptions that may apply. The form must be completed accurately and submitted to the appropriate tax authority.

What is the purpose of NY Real Property Transfer Tax Return?

The purpose of the NY Real Property Transfer Tax Return is to report property transfers to the state and to assess and collect the real property transfer tax, which is a tax imposed on the sale or transfer of real property.

What information must be reported on NY Real Property Transfer Tax Return?

The information that must be reported on the NY Real Property Transfer Tax Return includes the names and addresses of the grantor and grantee, the legal description of the property, the consideration or sales price, the date of transfer, and any applicable exemptions or deductions.

Fill out your NY Real Property Transfer Tax Return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Yonkers Real Chapter is not the form you're looking for?Search for another form here.

Keywords relevant to yonkers tax return

Related to yonkers return taxes

If you believe that this page should be taken down, please follow our DMCA take down process

here

.